Advantageous

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

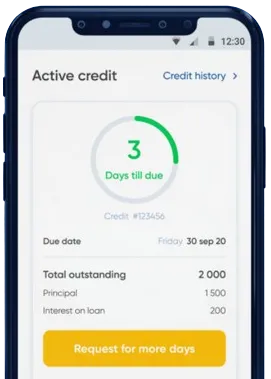

Seamless solutions in just 10 minutes from home. Instant money transfer and options to extend your loan

Apply conveniently via our app with a straightforward form.

Wait briefly for our decision, typically 15 minutes.

Obtain your funds, usually taking only one minute to transfer.

Apply conveniently via our app with a straightforward form.

Download loan app

Quick loans have become a popular financial option for many Kenyans in recent years. These loans are designed to provide fast and easy access to cash, making them ideal for those who need money quickly for unexpected expenses or emergencies. In this article, we will explore the benefits and usefulness of quick loans in Kenya.

One of the main reasons why quick loans are so popular in Kenya is because of their convenience and speed. Unlike traditional bank loans, which can take weeks to process, quick loans can be approved and disbursed within hours. This makes them an ideal option for those who need money urgently.

Overall, the convenience and speed of quick loans make them a great option for those who need fast access to cash.

Another benefit of quick loans in Kenya is that they typically have minimal documentation and requirements compared to traditional bank loans. This means that borrowers do not have to provide extensive paperwork or meet strict eligibility criteria to qualify for a quick loan.

Generally, all a borrower needs to provide is proof of identification, proof of income, and a bank account. This makes the application process quick and easy for those in need of funds.

Quick loans in Kenya also come with flexible repayment options, making it easier for borrowers to manage their finances. Borrowers can choose repayment terms that suit their financial situation, whether it's a short-term loan that needs to be repaid quickly or a longer-term loan with smaller monthly installments.

Overall, the flexibility in repayment options makes quick loans a convenient and useful financial tool for many Kenyans.

Quick loans are particularly useful for individuals who find themselves in need of emergency financial assistance. Whether it's a medical emergency, car repair, or unexpected bill, quick loans can provide the necessary funds to cover these expenses without delay.

By providing quick access to cash, quick loans can help borrowers alleviate financial stress and deal with emergencies promptly, ensuring that they can address urgent needs without delay.

Overall, quick loans in Kenya offer numerous benefits and are a useful financial tool for many individuals. With their convenience, speed, minimal requirements, flexible repayment options, and ability to provide emergency financial assistance, quick loans can be a practical solution for those in need of fast access to cash. However, borrowers should always evaluate their financial situation carefully and borrow responsibly to avoid getting into debt.

Quick loans are short-term loans that are typically processed and disbursed within a short period of time, often within 24 hours.

Anyone who is a Kenyan citizen or resident with a steady source of income can apply for a quick loan in Kenya. Lenders may have specific requirements, such as a minimum age or income level.

Most lenders in Kenya offer online platforms where you can fill out an application form and submit the necessary documents. Some lenders may also have physical branches where you can apply in person.

The interest rates for quick loans in Kenya can vary depending on the lender and the amount borrowed. It is important to compare rates from different lenders to find the best deal.

Repayment periods for quick loans in Kenya are typically short, ranging from a few weeks to a few months. It is important to understand the terms and conditions of the loan before accepting the funds.

Yes, there may be processing fees, late payment fees, or other charges associated with quick loans in Kenya. It is important to read the loan agreement carefully and understand all fees before accepting the loan.